Getting a high grade point average (GPA) is good, but getting a high credit score is great and has more impact on your future. Getting a student credit card while in school is an important first step.

For many young Canadians, a student credit card is their first experience with financing. They are starting to build their credit score. A credit card is the best way to do it.

- How to choose the right card? Use a comparison tool

- Best student cash back and rewards credit cards

- BMO CashBack® Mastercard®* for students

- L'earn Visa* Card

- CIBC Dividend Cash Back Visa Card for students

- Desjardins Cash Back Credit Cards

- RBC Cash Back Mastercard

- Laurentian Bank Visa Black Reward Me

- Best student cards for in-store discounts

- Best student travel cards

- BMO AIR MILES Mastercard

- CIBC Aventura Visa Card for Students

- CIBC Aero Visa Card for Students

- WestJet RBC Mastercard

- Alternative credit building products

How to choose the right card? Use a comparison tool

But how do you choose the right one? Hardbacon provides a credit card comparison tool to help you calculate how much cash back or rewards each card will give you based on your spending. For this article, we used a base of $1,600 in monthly spending. Here is the breakdown:

We compiled this list of the best credit cards for Canadian students. You'll see that some prepaid and secured credit cards also made the list. Why?

The lesson: credit is for building a good credit history

A credit card is a loan. Sometimes it's called revolving credit. A student credit card is avery adult thing.

The credit card issuer, like a bank, lends you money that you can use each month. The maximum they will lend you is your credit card's credit limit. You build your credit history and credit score by how well you borrow and pay back what you spend on your credit card.

If you want to build a credit score but don't want to apply for a traditional credit card or you are a foreign student cannot get a Canadian credit card, secured credit cards can help. Just note that they also report every month how much you borrow, how much you pay back, if you were late or unable to pay back what you owe.

Prepaid cards do not build your credit history, but they are easy to get and to use. One prepaid card in particular, the KOHO Prepaid Mastercard, has a credit building feature. With prepaid cards and secured credit cards, you can practice managing debt.

Here are our picks for student credit cards. We also included some secuured and prepaid cards.

Best student cash back and rewards credit cards

BMO CashBack® Mastercard®* for students

Annual fees: none

Interest rate: 20.99% on purchases/22.99% on balance transfers and cash advances (21.99% in Quebec)

Welcome Offer: 5% back on purchases made in the first 3 months

- Estimated rewards: $381

- Annual fee: $0

- Net value: $381

The BMO CashBack® Mastercard®* turns your purchases into cash. The discount rate is 3% for grocery store purchases, 1% on monthly bills such as streaming services or phone payments, and 0.5% on all other purchases.

Thanks to the welcome offer, the discount rate can be up to 5% during the first 3 months after joining, up to a maximum of $2,500. You could receive up to $125 in discounts.

These discounts do not expire and can be redeemed as soon as you accumulate $1. They are redeemable redeemed for a deposit in your BMO checking or savings account, a deposit to your InvestorLine Self-Directed account or a credit on your monthly statement. You can even set up an automatic deposit once a certain amount is reached, with a minimum of $25.

L'earn Visa* Card

Annual fees: none

Interest rate: 19.99% on purchases/22.99% on balance trasfers and cash advances (21.99% in Quebec)

- Estimated rewards: $192

- Annual fee: $0

- Net value: $192

The Scotia L’earn Visa Card is a student credit card that provides up to 1% cash back on purchases made with your card. Over the course of a year, the first $500 spent earns 0.25% back, the second $500 is 0.5% and then 1% after $1,000 of purchases spent.

CIBC Dividend Cash Back Visa Card for students

Annual fee: none

Interest rate: 19.99% on purchases/22.99% on balance transfers and cash advances (21.99% in Quebec)

Welcome Offer: get $60 after the first purchase in the first 4 months

- Estimated rewards: $303

- Annual fee: $0

- Net value: $303

The CIBC Dividend Visa for Students is a student credit card that has something for everyone. You earn 2% cash back on groceries, and 1% on other purchases. However, this card also gives you a free Student Price card (SPC), which lets you earn up tp 30% on purchases at hundreds of retailers.

If that wasn't enough, cardmembers get 0.125% cash back for every dollar spent on a CIBC Global Money Transfer™. If you send money abroad, you earn money back plus there are no transfer fees or interest charges if you pay on time.

It has a minimum limit of $1,000. Its interest rate is 20.99% on purchases and 21.99% on cash advances if you reside in Quebec, 22.99% for the rest of Canada. It also includes free enrollment in the SPC program, which offers hundreds of exclusive online and in-store offers, as well as $100,000 in accident insurance on public transit, and purchase insurance and extended warranties.

Desjardins Cash Back Credit Cards

Annual fee: none

Interest rate: 19.99%

Estimated rewards: $141

Annual fee: $0

Net value: $141

This is not a student credit card but a regular credit card that is just really good. As soon as you accumulate $25 in points, you can redeem it as a statement credit. Desjardins Visa Cash Back and Mastercard Cash Back credit cards provide up to 2% cash back at participating businesses in the following categories:

- Restaurants

- Entertainment

- Public transportation

- Pre-authorized debit

For all other spending categories, the discount is 0.5%. Desjardins offers an online calculator to estimate the amount of cash back and a list of participating retailers. These cards have no annual fee and additional cards are also free. They come with an interest rate of 19.99% on purchases and cash advances.

Visa and Mastercard Cash Back credit cards come with mobile devices protection including theft, loss and damage up to $1,000. They also offer insurance for trips of 3 days or less and you can get discounts on car rentals of up to 15% at Hertz and up to 10% at Thrifty and Dollar.

RBC Cash Back Mastercard

Annual fee: $0

Interest rate on purchases: 20.99%

Interest rate on cash advances: 22.99%

Estimated rewards: $252

Annual fee: $0

Net value: $252

This card gives you 2% cash back on groceries and 1% back on all other qualifying purchaes and pre-authorized payments. It also saves you $0.03 per liter of fuel at Petro-Canada and earn 20% more Petro-Points.

It also gives you access to a three-month subscription for DoorDash DashPass, valued at $30. This allows you to avoid delivery costs on orders of $15 or more, with no transaction limits. You can even get up to 12 months of free delivery, valued at $120. Of course, you need to pay for your food with your RBC Cash Back Mastercard. Don't forget to link your card to the Ampli cash-back app to get even more money.

This card has no fees and additional cards are also free. Its interest rate is 19.99% on purchases and 21.99% on cash advances for Quebec residents. This rate is 22.99% for the rest of Canada.

Laurentian Bank Visa Black Reward Me

Annual fee: $3.50 per month, free if $350 purchases per month

Interest rate: 19.99% on purchases/22.99% on balance trasfers and cash advances (21.99% in Quebec)

The Visa Black Reward Me credit card allows you to accumulate points that can be redeemed for gift cards at more than 80 merchants including gas stations, grocery stores and pharmacies. You can also redeem them for Laurentian Bank gift cards applicable on investment products, or items available in the bank's Rewards zone. For every dollar spent on gas, groceries, and pre-authorized payments, you'll get one point. All other eligible purchases earn you 0.5 points per dollar.

This credit card also includes a 90-day purchase protection insurance against theft and accidental damage to items purchased with your card as well as an extended manufacturer's warranty insurance for up to one year.

The interest rate for purchases is 19.99% and 21.99% for cash advances. The card is available for $3.50 per month. Fees are waived if you spend more than $350 in a month.

Best student cards for in-store discounts

RBC ION Visa

Get 3,500 Welcome Points on approval and earn 3,500 bonus points when you spend $500 in your first 3 months*. Apply by May 29 2023.

Estimated rewards: $268.80

Annual fee: $0

Net value: $268.80

The RBC ION Visa allows you earn 1.5X Avion points for every $1 spent on groceries. You also earn 1.5 points on every $1 spent on:

- Ride sharing

- Public transit

- Gas

- Electric vehicle charging.

You earn 1 point for every $1 spent on other qualifying purchases.

You also earn bonus points when you make purchases at select retailers. It gives you the option to convert your points for a wide range of options, such as gifts or travel.

This card has no annual fees. Its interest rate is 19.99% on purchases and 21.99% on cash advances for Quebec residents, 22.99% for the rest of Canada.

This credit card also offers a $0.03 discount on every liter of fuel at Petro-Canada and 20% off RBC Rewards points in-store, as well as the 3 month DoorDash DashPass subscription. You can also earn cash back, by linking your RBC card to the Ampli app.

Best student travel cards

BMO AIR MILES Mastercard

Annual fee: none

Interest rate: 20.99% on purchases/22.99% on balance trasfers and cash advances (21.99% in Quebec)

Estimated rewards: $96

Annual fee: $0

Net value: $96

If you're looking to earn miles to travel, the BMO AIR MILES Student Mastercard is for you. It earns 1 mile for every $25 of purchases, and miles are tripled at some participating stores, such as IGA, Shell, Jean-Coutu and Staples. Finally, you also double your AIR MILES rewards by presenting your credit card with your membership card.

As a welcome offer, you receive 800 bonus AIR MILES. Air MILES can be redeemed for travel, hotel stays, items or cash back on your purchases. A miles calculator is available on the BMO website.

This card is available with no fees and has an interest rate on purchases of 19.99%. Cash advances are at a rate of 21.99% for residents of Quebec and 22.99% for the rest of Canadians. To qualify, you must be a Canadian citizen or resident between the ages of 18 and 24 and be enrolled in a post-secondary institution. You must also have an annual income from employment, loan, grant, scholarship or family allowance.

With the BMO AIR MILES Mastercard for Students, you are entitled to extended warranty insurance and purchase insurance. You are also entitled to discounts of up to 25% at National Car Rental and Alamo Rent A Car rental locations.

CIBC Aventura Visa Card for Students

Annual fee: none

Interest rate: 19.99% on purchases/22.99% on balance trasfers and cash advances (21.99% in Quebec)

Estimated rewards: $160.08

Annual fee: $0

Net value: $160.08

The CIBC Aventura Visa Card for Students allows you to earn points on all your purchases. You receive an Aventura Bonus Point for every dollar spent at gas stations, grocery stores and pharmacies, as well as for any travel purchased through the CIBC Rewards Centre. On all other purchases, every $2 earns you a point.

The current welcome offer gives you the chance to accumulate up to 2,500 points. Simply complete the following five activities, for 500 points each, within 60 days of signing up:

- Provide your email address to CIBC

- Opt in for electronic statements

- Add an authorized user to your Aventura Visa card

- Be an eligible CIBC checking account holder

- Add your Aventura Visa card to Apple Pay, Google Pay or Samsung Pay

You can redeem these points for airfare, hotel stays or vacation packages, as well as items, gift cards and activities. You can also pay off your credit card balance with your points, or contribute to a CIBC financial product. This credit card also includes free enrollment in the SPC program, which allows you to save at more than 450 in-store and online offers.

This card has no fees. It comes with an interest rate 20.99% on purchase, and cash advances are 21.99% for Quebec residents and 22.99% for the rest of the country. The minimum credit limit is $1,000. It also offers collision/damage insurance for rental vehicles, $100,000 accident insurance on public transit, as well as purchase insurance and extended warranties.

CIBC Aero Visa Card for Students

Annual fee: none

Welcome offer: 10,000 Aeroplan points

Interest rate: 19.99% on purchases/22.99% on balance trasfers and cash advances (21.99% in Quebec)

Estimated rewards: $192.38

Annual fee: $0

Net value: $192.38

The CIBC Aeroplan Visa Card for Students allows you to earn Aeroplan points while shopping. For every dollar you spend on gas, groceries or Air Canada, you get one point. All your other purchases earn one point for every $1.50 spent. In addition, you can earn twice the points at 150 Aeroplan partner brands and 170 retailers in the Aeroplan online retailers.

As a welcome offer, you will receive 10,000 Aeroplan bonus points on your first purchase with your card. You can redeem these points for flights with Air Canada and its partner carriers. You can also exchange them for items and gift cards.

This card has no fees and does not require a minimum income. It comes with an interest rate on purchases of 20.99% and cash advances are at 21.99% in Quebec, and 22.99% for the rest of Canada. The minimum credit limit is $1,000.

This credit card also offers a six-month subscription to UberPass. This includes free delivery on Uber Eats orders and 5% discounts on purchases over $15. CIBC Visa Aeroplan for Students also offers collision/property and casualty insurance for rental vehicles, $100,000 accident insurance for public transit, and purchase insurance and extended warranties.

WestJet RBC Mastercard

Annual fee: $39

Interest rate:19.99% for purchases/ 22.99% for balance transfers and cash advance

Estimated rewards: $192

Annual fee: $0 for eligible students

Net value: $192

The WestJet RBC Mastercard is $39 a year. This card gives access to travel points quickly. You earn WestJet dollars and get an annual free companion travel voucher.

You get 1.5% back in WestJet dollars on WestJet travel, and 1% on all other current purchases. As a welcome offer, you also get up to $100 WestJet dollars if you make more than $1,000 in purchases within three months of joining. Link your card to the Ampli cash-back app for even more money in your pockets.

This card also entitles you to a $0.03 discount on a liter of gas at Petro-Canada, plus you earn 20% more Petro-Points. You also get a free three month subscription to DoorDash. Like other RBC credit cards, you can get up to 12 months of free DoorDash delivery for orders over $15 purchased with your card.

Other benefits include travel accident insurance coverage, protection for your hotel stays, rental cars insurance, and insurance for eligible purchases. The WestJet RBC Mastercard comes with an interest rate on purchases of 19.99% and cash advances are at 22.99%.

Alternative credit building products

KOHO Prepaid Mastercard

- KOHO is a full-service app and reloadable prepaid credit card with no hidden fees.

- Get $20 when you sign up for a free KOHO account with code HARDBACON and make your first purchase*.

Estimated rewards: $204

Annual fee: $0 to $84 depending on account

Net value: $204/$124

The KOHO Prepaid Mastercard belongs in every category on this list except it's not a credit card. It is a perpaid card with a credit-building option. The credit building option costs you $10 a month with a free account, and $7 a month with one of the paid account. There is no interest rate.

KOHO reports your on-time payments to the credit bureaus. Voilà! You are building your credit score with money you already have.

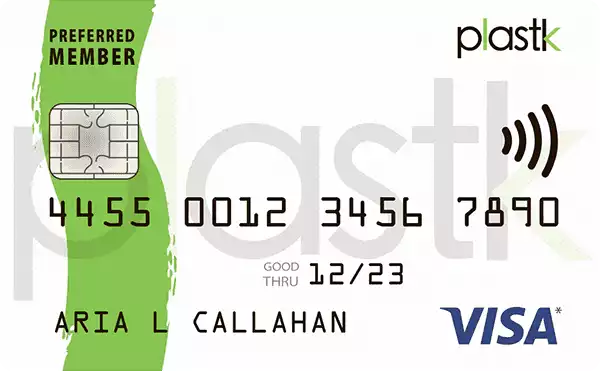

The Plastk Secured Credit Card

Annual fee: $48

Monthly maintenance fee: $6

Interest rate: 17,99 %

The Plastk Secured Credit Card is different from the others on this list since it requires a security deposit. It is aimed at those looking to build their credit or improve a bad credit score. The required deposit ranges from $300 to $10,000, and the card has an annual fee of $48 as well as a maintenance fee of $6 per month, for a total of $120 per year.

This card has a 17.99% interest rate on purchases and a generous 25-day interest-free grace period to pay balances. The rate on cash advances is 21.99%. Plastk also takes care of reporting your credit score to the credit bureaus, and you are able to view your score monthly on the mobile app.

With Plastk, you also have access to a rewards program. You earn one point per dollar spent, and then each 250 points has a value of $1. These points can be used to pay your balance or to purchase products and services. You can also earn points by referring friends, each referral earns you 1,250 points.

Neo Financial Secured Card

- Annual fee : 0$

- Interest Rate : Up to 24.99%

5% Average cashback - Earn an average of 5% unlimited cashback⁴ at thousands of Neo partners.

The Neo Secured Card is great for students. It is free, and all you need is security funds of minimum $50. With this card, you can earn an average of 5% cash back with thousands of Neo partners, and a guarantee of at least 0,5% on all your purchases. What's better, some participating partners give you up to 15% cash back on your first purchase!

About The Author: Sophie Albo

Sophie is the content specialist at Hardbacon. She is currently in her 3rd year of a bachelor's degree in marketing at Concordia University. Her passion for Fintech and was revealed during the 2016 Cooperathon where she received special award.

More posts by Sophie Albo